"A proud heart can survive a general failure because such a failure does not prick its pride.” African Proverb

Shem Hotep ("I go in peace").

Post-traumatic stress disorder or Posttraumatic Slave Syndrome.

The African American slavery experience has involved every possible cause for post-traumatic stress disorder, or Posttraumatic Slave Syndrome.

Bling, Bling - The Murder of Our People.

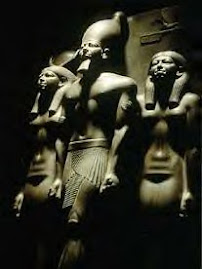

The "Bling" Has Got to Give. Their Own COM modification”. If a picture is worth a thousand words, this picture might be a mini novel.

The "Bling" Has Got to Give.

USA Today article on Black spending habits. Alarming but not surprising!

These are tough economic times, especially for African-Americans, for whom the unemployment rate is more than 10%. Alarmingly, rather than belt-tightening, the response has been to spend more. In many poor neighborhoods, one is likely to notice satellite dishes and expensive

new cars.

According to Target Market, a company that tracks black consumer spending, blacks spends a significant amount of their income on depreciable products. In 2002, the year the economy nose-dived; we spent $22.9 billion on clothes, $3.2 billion on electronics and $11.6 billion on furniture to put into homes that, in many cases, were rented. Among our favorite purchases are cars and liquor. Blacks make up only 12% of the U.S.population, yet account for 30% of the country’s Scotch consumption.

Detroit, which is 80% black, is the world’s No. 1 market for Cognac.

(Embarrassing)

So impressed was Lincoln with the $46.7 billion that blacks spent on cars that the automaker commissioned Sean "P. Diddy" Combs, the entertainment and fashion mogul, to design a limited-edition Navigator replete with six plasma screens, three DVD players and a Sony PlayStation 2. The only area where blacks seem to be cutting back on spending is books; total purchases have gone from a high of $356 million in 2000 to $303 million in 2002. This shortsighted behavior, motivated by a desire for instant gratification and social acceptance, comes at the expense of our future.

The National Urban League’s "State of Black America 2004" report found that fewer than 50% of black families owned their homes compared with more than 70% of whites.According to published reports, the Ariel Mutual Funds/Charles Schwab 2003 Black Investor Survey found that when comparing households where blacks and whites had roughly the same household incomes, whites saved nearly 20% more each month for retirement, and 30% of African-Americans earning $100,000 a year had less than $5,000 in retirement savings. While 79% of whites invest in the stock market, only 61% of African-Americans do. Certainly, higher rates of unemployment, income disparity and credit discrimination are financial impediments to the economic vitality of blacks, but so are our consumer tastes. By finding the courage to change our spending habits, we might be surprised at how far the $631 billion we now earn might take us.